A 46 percent jump in price is definitely significant. That is precisely what happened with the price of nickel, rising from $5.60/lb. on July 1 to $8.15/lb. on September 1. This is notable because the price of nickel currently accounts for 55-65 percent of the 300 series stainless surcharge variations.

Surcharges are additional charges that are linked to the underlying prices of the metals used in stainless production. These are additive to the base price charged by the mill. The base price for each is established by the following:

| Alloy Content | Production Cost (varies by size/form) | Yield Factor | Supply/demand Fundamentals |

Two surcharges that are tracked closely are 304 and 316. Looking at the alloy content element of the equation, we see that nickel is a primary alloy for both 304 and 316, which contain roughly 8% and 10%, respectively. Overall, supply/demand fundamentals related to nickel can impact the price of each surcharge--some even in an indirect manner.

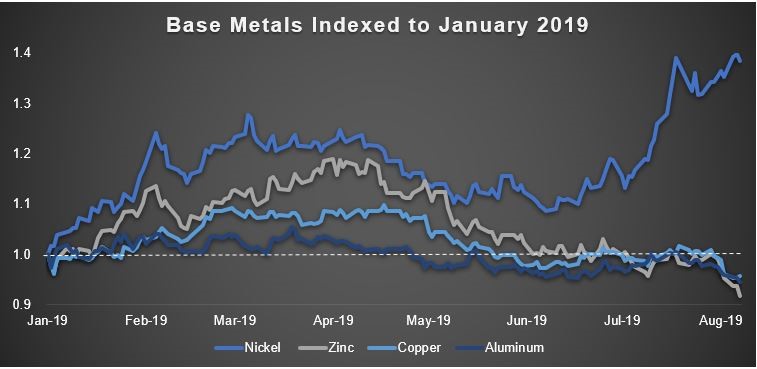

Perhaps even more notable is the fact that the nickel market has experienced this sharp rally while many of its base metal peers have sold off. In fact, as of August 7, aluminum, copper, and zinc are all trading at year-to-date lows while nickel trades within pennies of its year-to-date high. This can be seen very clearly in the chart below.